Reserve Bank’s August 1 Rate Cut to 7%: In a significant move, August 1 marks a historic decision by the South African Reserve Bank to reduce the interest rate to 7%. This strategic action aims to stabilize the economy and steer inflation towards the target of 3%. Amidst a backdrop of economic challenges, this decision is seen as a bold step to foster growth and provide relief to businesses and consumers struggling with the pressures of high borrowing costs. The reduction in the rate is expected to have widespread implications across various sectors, influencing everything from loan affordability to investment prospects.

Reasons Behind the Reserve Bank’s Rate Cut

The decision to slash the interest rate to 7% is grounded in several key economic factors. Primarily, the Reserve Bank intends to stimulate economic growth by making borrowing cheaper for both individuals and businesses. This move comes in response to sluggish economic performance and the need to boost consumer spending and investment. Additionally, the global economic landscape and fluctuating commodity prices have put pressure on local markets, necessitating a proactive approach. The Reserve Bank’s target of 3% inflation is also central to this decision, as a lower rate can help maintain price stability and enhance purchasing power.

R18.23 Exchange Rate Spike: How South Africans Will Feel the Pinch on Groceries, Petrol, and Imports

R18.23 Exchange Rate Spike: How South Africans Will Feel the Pinch on Groceries, Petrol, and Imports

- Stimulate economic growth

- Enhance consumer spending

- Boost investment

- Maintain price stability

- Respond to global economic pressures

- Support local businesses

- Achieve target inflation rate of 3%

Impact of the Rate Cut on South African Economy

The Reserve Bank’s rate cut is expected to have a profound impact on the South African economy. For consumers, lower interest rates typically translate into more affordable home loans and credit, potentially leading to increased spending. For businesses, reduced borrowing costs can result in increased investments and expansion opportunities. Additionally, the move may attract foreign investment, as lower rates can improve the country’s economic outlook. However, there are concerns about the potential for increased inflation if the economy overheats, and the Reserve Bank will need to monitor economic indicators closely to maintain balance.

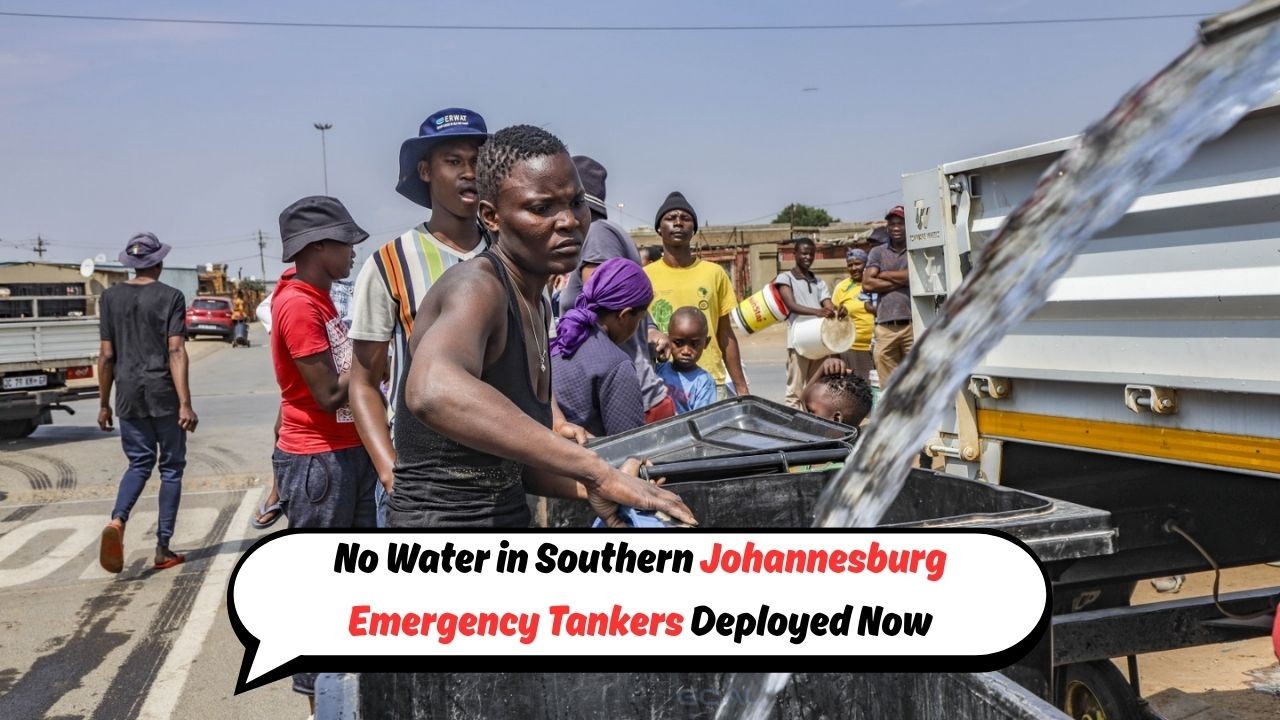

Johannesburg Faces Major Water Crisis: Government Rushes Tankers to Combat Failing Pipelines

Johannesburg Faces Major Water Crisis: Government Rushes Tankers to Combat Failing Pipelines

| Sector | Positive Impact | Negative Impact |

|---|---|---|

| Consumers | More affordable loans | Potential for rising inflation |

| Businesses | Cheaper borrowing | Risk of economic overheating |

| Investors | Attractive investment climate | Currency volatility |

| Government | Economic growth stimulation | Budget constraints |

| Financial Markets | Increased activity | Interest rate risks |

| Exporters | Competitive edge | Exchange rate fluctuations |

| Importers | Lower costs | Trade balance issues |

| General Public | Improved economic confidence | Inflationary pressures |

Inflation Targeting and Economic Stability

Inflation targeting remains a crucial aspect of the Reserve Bank’s monetary policy strategy. By aiming for a 3% inflation rate, the bank seeks to ensure long-term economic stability and protect the purchasing power of the Rand. A stable inflation rate is essential for maintaining confidence among consumers and investors, as it provides a predictable economic environment. The decision to cut rates is a calculated risk, as it involves balancing the immediate need for growth with the long-term goal of price stability. The Reserve Bank will employ various tools and strategies to monitor and control inflation, adjusting policies as necessary to achieve its targets.

- Ensuring economic stability

- Protecting purchasing power

- Maintaining consumer confidence

- Balancing growth and inflation

Understanding the Impact of a 7% Rate

| Interest Rate | Effect on Loans | Effect on Savings |

|---|---|---|

| 7% | Reduced cost | Lower returns |

| 8% | Moderate cost | Moderate returns |

| 9% | Higher cost | Higher returns |

| 10% | Significantly higher cost | Significantly higher returns |

| 11% | Restrictive cost | Very high returns |

| 12% | Prohibitive cost | Exceptional returns |

Global Economic Context of Rate Adjustments

The Reserve Bank’s decision does not occur in isolation but is part of a broader global economic context. Various central banks worldwide are grappling with similar economic challenges, including sluggish growth and inflationary pressures. South Africa’s interest rate cut aligns with a global trend of monetary easing, as countries strive to support their economies amidst uncertainties such as trade tensions and geopolitical risks. By adjusting rates, the Reserve Bank aims to remain competitive and attractive to international investors while safeguarding domestic economic interests.

- Global trend of monetary easing

- Trade tensions and uncertainties

- Geopolitical risks

- Attracting international investments

- Safeguarding domestic interests

The Path Forward for South Africa’s Economy

- Monitor economic indicators closely

- Adjust policies as needed

- Encourage sustainable growth

- Foster an attractive investment climate

- Balance domestic and international interests

FAQs: Understanding the Reserve Bank’s Rate Cut

How does the rate cut affect home loans?

The rate cut makes home loans more affordable, reducing monthly payments for borrowers.

Will the rate cut lead to inflation?

While there is a potential risk of inflation, the Reserve Bank aims to control this through careful monitoring and policy adjustments.

How does this impact foreign investment?

Lower rates can make South Africa more attractive to foreign investors, improving economic prospects.

What sectors benefit the most from the rate cut?

Consumers, businesses, and investors are likely to see the most significant benefits from cheaper borrowing costs.

How will the Reserve Bank ensure economic stability?

The bank will use various tools to monitor inflation and adjust policies to maintain stability and growth.

How does the Reserve Bank cutting the interest rate to 7% affect consumers and the economy?

When the Reserve Bank reduces the interest rate to 7%, it can have several impacts on consumers and the economy. Lower interest rates can lead to reduced borrowing costs, making it cheaper for individuals and businesses to borrow money for investments, such as buying a home or expanding a business. This can stimulate spending and investment, potentially boosting economic activity. However, lower interest rates can also lead to lower returns on savings accounts and other investments, which may affect individuals who rely on interest income. Additionally, lower interest rates can sometimes lead to increased inflation if the economy overheats.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several implications for the economy and consumers. This move aims to stimulate economic growth by making borrowing cheaper, which can encourage businesses to invest and consumers to spend. Lower interest rates can also make mortgages more affordable, potentially boosting the housing market. However, it may also lead to lower returns on savings accounts and investments, impacting savers who rely on interest income. Overall, the impact of the rate cut will depend on various factors, including how financial institutions respond and how consumers and businesses adjust their spending and investment decisions.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and individuals?

The Reserve Bank's decision to lower the interest rate to 7% can have various effects on the economy and individuals. It can stimulate economic growth by making borrowing cheaper, which may lead to increased investment and spending. However, it can also impact savers negatively as they may receive lower returns on their savings. Additionally, lower interest rates can lead to increased inflation as consumers may be more inclined to spend, potentially pushing prices higher. Overall, the impact of this rate cut will depend on various factors such as the current state of the economy, consumer behavior, and government policies.

How will the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy. It may stimulate borrowing and spending as borrowing becomes cheaper, which could potentially boost economic activity. However, it could also lead to lower returns on savings and investments for individuals and could potentially contribute to inflation if demand for goods and services increases significantly.

How does the Reserve Bank's decision to lower the interest rate to 7% impact consumers and the economy?

The Reserve Bank's move to slash the interest rate to 7% can have several effects on consumers and the economy. Lower interest rates can lead to reduced borrowing costs for individuals and businesses, making it cheaper to take out loans for things like mortgages, car purchases, and business investments. This can stimulate spending and investment, potentially boosting economic activity. On the other hand, lower interest rates can also lead to lower returns on savings and investments, affecting people who rely on interest income. Additionally, the Reserve Bank's aim to achieve 3% inflation through this rate cut may also impact the cost of goods and services, influencing overall consumer prices.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy. It can stimulate borrowing and spending as lower interest rates make it cheaper for consumers and businesses to borrow money. This can potentially boost economic activity, investment, and job creation. However, it may also lead to lower returns on savings and investments, impacting those who rely on interest income. Additionally, the move aims to achieve a target inflation rate of 3%, which can help maintain price stability and support overall economic growth.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy and individuals?

The Reserve Bank's decision to lower the interest rate to 7% can have several implications. For the economy as a whole, it can stimulate borrowing and spending, which may lead to increased investment and economic growth. Lower interest rates can also make it more affordable for businesses to borrow money for expansion or investment, potentially creating job opportunities. On the individual level, lower interest rates can mean cheaper borrowing costs for mortgages, car loans, and other types of loans, which can result in increased consumer spending. However, it may also lead to lower returns on savings and investments, affecting those who rely on interest income.

How will the Reserve Bank's rate cut to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% is aimed at stimulating economic growth by making borrowing cheaper. This move can lead to increased spending and investment, potentially boosting economic activity. For consumers, lower interest rates may translate into reduced borrowing costs for loans such as mortgages and car loans, making it more affordable for individuals to make large purchases or investments.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate can have several effects on the economy. It can stimulate borrowing and spending as lower interest rates make it cheaper to borrow money, leading to increased investment and consumer spending. This can potentially boost economic activity and help stimulate growth. On the other hand, lower interest rates can also lead to lower returns on savings and investments, affecting individuals who rely on interest income. Additionally, lower interest rates can influence exchange rates and inflation levels, impacting various sectors of the economy.

How does the Reserve Bank lowering the interest rate to 7% impact the economy?

The Reserve Bank's decision to slash the interest rate to 7% can have various impacts on the economy. Lower interest rates generally encourage borrowing and spending, which can stimulate economic growth. It can make borrowing cheaper for businesses and individuals, leading to increased investment, consumption, and potentially higher employment levels. However, it can also lead to lower returns on savings and investments, impacting those who rely on interest income. Overall, the aim of reducing the interest rate is to support economic activity and achieve the targeted inflation rate of 3%.

How does the Reserve Bank cutting the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to reduce the interest rate to 7% can have several effects on the economy and consumers. Lower interest rates can stimulate borrowing and spending, leading to increased investment and economic growth. This can also make borrowing cheaper for consumers, encouraging them to take out loans for big purchases like homes or cars. However, it can also lead to lower returns on savings accounts and fixed deposits, impacting those who rely on interest income. Overall, the goal of this rate cut is to achieve a target inflation rate of 3%, which can have a range of implications for various sectors of the economy.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. For the economy, it can stimulate borrowing and spending, which can lead to increased economic activity and growth. Lower interest rates can also make it cheaper for businesses to borrow money for investments, potentially boosting productivity and job creation. For consumers, lower interest rates can mean reduced borrowing costs for things like mortgages, car loans, and credit cards, making it more affordable to make large purchases or invest in property. However, it can also lead to lower returns on savings accounts and other investments, impacting those who rely on interest income.

How does the Reserve Bank cutting the interest rate to 7% impact the economy?

The Reserve Bank's decision to slash the interest rate to 7% can have several effects on the economy. Lowering the interest rate encourages borrowing and spending, stimulating economic activity. This can lead to increased investments in businesses, higher consumer spending, and potentially lower unemployment rates. On the flip side, a lower interest rate can also lead to higher inflation, as the cost of borrowing decreases and money supply increases. It's a balancing act for the Reserve Bank to achieve its target inflation rate of 3% while supporting economic growth.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. Firstly, it can lead to lower borrowing costs, making it cheaper for consumers to take out loans for purchases such as homes or cars. This can stimulate spending and investment, boosting economic activity. On the other hand, lower interest rates can also lead to lower returns on savings accounts and other fixed-income investments, affecting savers who rely on these for income. Overall, the rate cut is aimed at achieving a 3% inflation target, which can help maintain price stability and support economic growth.

How will the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. For consumers, it may lead to lower borrowing costs, making it cheaper to take out loans for things like mortgages or business investments. This could potentially stimulate spending and investment, boosting economic activity. On the other hand, lower interest rates can also mean lower returns on savings accounts and other fixed-income investments, affecting those who rely on interest income. Overall, the goal of targeting 3% inflation is to strike a balance between promoting economic growth and maintaining price stability.

How might the Reserve Bank's decision to lower the interest rate impact the economy and individuals?

The Reserve Bank's move to reduce the interest rate can have various effects. It can make borrowing cheaper, encouraging businesses and individuals to take out loans for investments or purchases. This can stimulate spending and boost economic activity. On the other hand, lower interest rates can lead to decreased returns on savings and investments, potentially affecting individuals who rely on interest income. Overall, the goal is to promote economic growth and manage inflation rates.

How does the Reserve Bank cutting the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. It may lead to lower borrowing costs, making it cheaper for individuals and businesses to take out loans for investments or purchases. This could stimulate spending and investment, potentially boosting economic activity. On the flip side, lower interest rates can also reduce the returns on savings accounts and other low-risk investments, affecting individuals who rely on these sources of income. Additionally, the move is aimed at achieving a 3% inflation target, which could influence pricing dynamics and consumer purchasing power.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to reduce the interest rate to 7% can stimulate economic growth by making borrowing cheaper for businesses and individuals. This can encourage spending, investment, and ultimately boost economic activity. Additionally, lowering interest rates can help control inflation and support employment levels.

How does the Reserve Bank’s decision to slash the rate to 7% impact the economy and individuals?

The Reserve Bank's decision to lower the interest rate to 7% can have various effects on the economy and individuals. For the economy, it may stimulate borrowing and spending, leading to increased economic activity. This can potentially boost investments, create job opportunities, and fuel overall growth. On the downside, lower interest rates can also lead to inflationary pressures if not managed effectively. For individuals, lower interest rates may mean cheaper borrowing costs for mortgages, loans, and credit cards, making it more affordable to make big purchases or invest in property. However, it could also result in lower returns on savings and investments, impacting those who rely on interest income.

How might the Reserve Bank's decision to lower the interest rate impact the economy and individuals?

The Reserve Bank's decision to lower the interest rate can have several effects on the economy and individuals. For the economy, it can stimulate borrowing and spending, leading to increased investment and economic growth. Lower interest rates can also make it cheaper for businesses to borrow money for expansion, which can create more jobs. On the other hand, lower interest rates can lead to lower returns on savings and investments, impacting individuals who rely on interest income. Additionally, lower interest rates can contribute to inflation as increased spending can drive up prices.

How does the Reserve Bank cutting the interest rate to 7% affect consumers and businesses?

The Reserve Bank's decision to reduce the interest rate to 7% can have several implications for consumers and businesses. For consumers, this could mean lower interest rates on loans, such as mortgages and personal loans, making borrowing more affordable. On the other hand, savers might see a decrease in the interest earned on their savings accounts. For businesses, lower interest rates can lead to reduced borrowing costs, potentially encouraging investment and expansion. However, it could also impact returns on savings and investments for businesses.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several impacts on the economy. It can stimulate borrowing and spending as lower interest rates make it cheaper for consumers and businesses to access credit. This can lead to increased investment, consumption, and economic growth. On the other hand, lower interest rates can also lead to lower returns on savings and investments, potentially affecting savers and retirees who rely on interest income. Additionally, the move is aimed at achieving a target inflation rate of 3%, which can help stabilize prices and support economic growth.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower interest rates to 7% can have several effects on the economy. It can stimulate borrowing and spending as loans become more affordable, potentially boosting economic activity. However, it may also lead to lower returns on savings and investments, impacting those who rely on interest income. Additionally, the move is aimed at achieving a 3% inflation target, which can influence consumer purchasing power and overall price levels in the economy.

How does the Reserve Bank's decision to lower the interest rate to 7% impact the economy and consumers?

The Reserve Bank's move to reduce the interest rate to 7% has several implications. Lowering the interest rate can stimulate borrowing and spending in the economy, as it becomes cheaper to take out loans for businesses and individuals. This can boost economic activity and potentially lead to increased investments. On the consumer side, lower interest rates can mean reduced mortgage payments for those with variable interest rate mortgages, potentially freeing up more disposable income. However, it's essential to keep in mind that the impact can vary depending on individual financial situations and market conditions.

How does the Reserve Bank's decision to reduce the interest rate to 7% impact the economy?

The Reserve Bank's decision to slash the interest rate to 7% can have several effects on the economy. Firstly, it can make borrowing cheaper, encouraging businesses and individuals to take out loans for investments or purchases. This can stimulate economic activity and potentially boost consumer spending. On the other hand, lower interest rates can also lead to decreased returns on savings and investments, impacting savers and retirees who rely on interest income. Additionally, lower interest rates can influence exchange rates and the cost of imports and exports, affecting international trade. Overall, the Reserve Bank's move aims to manage inflation and support economic growth during uncertain times.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy?

The Reserve Bank's move to lower the interest rate to 7% can have several effects on the economy. It can stimulate borrowing and spending as lower interest rates make it cheaper to borrow money. This can lead to increased investment in businesses and real estate, which can help boost economic growth. Additionally, lower interest rates can make saving less attractive, encouraging people to spend more, further stimulating economic activity. However, lower interest rates can also lead to lower returns on savings and investments, potentially impacting those who rely on interest income.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy. It can stimulate borrowing and spending as lower interest rates make it cheaper for consumers and businesses to access credit. This, in turn, can boost economic activity, encourage investment, and potentially lead to higher employment levels. On the flip side, lower interest rates can also lead to lower returns on savings and investments, affecting those who rely on interest income. Overall, the impact of the rate cut will depend on various factors such as consumer behavior, market conditions, and government policies.

How does the Reserve Bank's decision to slash the rate to 7% impact borrowers and savers?

The Reserve Bank's decision to lower the interest rate to 7% can have different effects on borrowers and savers. Borrowers may benefit from lower interest rates on loans, making it cheaper to borrow money for various purposes such as buying a home or starting a business. On the other hand, savers may see lower returns on their savings in terms of interest earned on deposits and investments.

How does the Reserve Bank cutting the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. It may lead to cheaper borrowing costs, encouraging businesses and individuals to take out loans for investments or purchases. This can stimulate economic activity, boost spending, and potentially create jobs. On the other hand, lower interest rates can also reduce the returns on savings accounts and fixed-income investments, affecting savers and retirees who rely on interest income. Additionally, a lower interest rate can influence exchange rates, inflation, and overall economic growth.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to reduce the interest rate to 7% can have several effects on the economy and consumers. Lower interest rates can encourage borrowing and spending, stimulating economic growth. This can lead to increased investment in businesses, higher consumer spending, and potentially lower unemployment rates. However, it can also lead to higher inflation if demand outstrips supply. For consumers, lower interest rates can mean cheaper loans for mortgages, car purchases, and other big-ticket items, but it can also result in lower returns on savings accounts and other investments.

How will the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to cut the interest rate to 7% can have several effects on the economy and consumers. Lower interest rates typically make borrowing cheaper, which can stimulate spending and investment, leading to economic growth. Consumers may benefit from lower interest rates on loans, such as mortgages and car loans, making it more affordable to borrow money. However, lower interest rates can also impact savings and returns on investments, as interest rates on savings accounts and fixed deposits may decrease. Overall, the impact of the rate cut will depend on various factors, including individual financial circumstances and the overall economic environment.

How does the Reserve Bank cutting the interest rate to 7% impact the economy?

The Reserve Bank cutting the interest rate to 7% can have several effects on the economy. It can make borrowing cheaper, encouraging businesses and individuals to take out loans for investments or spending. This can stimulate economic growth and increase consumer spending. However, it can also lead to lower returns on savings accounts and fixed investments, impacting those who rely on interest income. Additionally, lower interest rates can sometimes lead to inflation as demand increases, so the Reserve Bank aims to balance these factors to achieve its target inflation rate of 3%.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several impacts on the economy. It can stimulate borrowing and spending as lower interest rates make borrowing cheaper, encouraging businesses and individuals to invest and consume more. This can lead to increased economic activity, job creation, and overall growth. However, lower interest rates can also lead to lower returns on savings and investments, potentially impacting those who rely on interest income. Additionally, the move aims to target a 3% inflation rate, which can help promote price stability and support economic growth.

How does the Reserve Bank's decision to reduce the interest rate to 7% impact the economy and individuals?

The Reserve Bank's move to lower the interest rate to 7% has several implications for the economy and individuals. For the economy, a lower interest rate can stimulate borrowing and spending, which can boost economic activity. It can also make it cheaper for businesses to borrow money for investments, potentially leading to job creation and growth. On the other hand, for individuals, lower interest rates can mean reduced borrowing costs for mortgages, loans, and credit cards. This can make it more affordable for individuals to make big purchases or invest in property. However, lower interest rates can also lead to lower returns on savings accounts and fixed-income investments, affecting those who rely on interest income for their financial security.

How does the Reserve Bank's decision to slash the rate to 7% affect the economy?

The Reserve Bank's decision to lower the interest rate to 7% can potentially stimulate economic activity by making borrowing cheaper, which may encourage businesses and individuals to invest and spend more. This move aims to boost economic growth and increase inflation towards the target rate of 3%.

How does the Reserve Bank's decision to lower the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have various effects on the economy and consumers. Lowering the interest rate can encourage borrowing and spending, which can stimulate economic growth. It can lead to lower interest payments on existing loans, making it cheaper for consumers and businesses to borrow money. However, it may also result in lower returns on savings and investments. Overall, the impact will depend on various factors such as the current economic conditions and individual financial situations.

How will the Reserve Bank's decision to lower the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to reduce the interest rate to 7% can have several effects on the economy and consumers. Lower interest rates typically encourage borrowing and spending, which can stimulate economic activity. This can lead to increased investment, job creation, and overall economic growth. For consumers, lower interest rates may result in reduced borrowing costs for things like mortgages, loans, and credit cards, making it more affordable to make big purchases or investments. On the other hand, lower interest rates can also lead to lower returns on savings accounts and other interest-bearing investments, potentially impacting those who rely on interest income.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and individuals?

The Reserve Bank's decision to lower the interest rate to 7% can have various impacts on the economy and individuals. For the economy, a lower interest rate can stimulate economic growth by making borrowing cheaper for businesses and consumers. This can lead to increased investments, spending, and overall economic activity. However, it can also lead to higher inflation if not managed properly. For individuals, a lower interest rate can mean lower mortgage rates, making it more affordable to buy a home or refinance existing loans. It can also lead to lower interest rates on savings accounts, impacting savers who rely on interest income.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to reduce the interest rate to 7% can have several implications for the economy and consumers. Lower interest rates typically stimulate borrowing and spending, as it becomes cheaper for individuals and businesses to borrow money. This can lead to increased investments, economic growth, and potentially higher inflation rates, which align with the Reserve Bank's goal of achieving 3% inflation. However, lower interest rates can also lead to decreased savings returns for individuals and potentially contribute to asset price inflation. Overall, the impact on the economy and consumers will depend on various factors and how they respond to the change in interest rates.

How does the Reserve Bank's decision to cut the interest rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy. It can stimulate borrowing and spending, making it cheaper for businesses and individuals to access credit. This can boost economic activity, leading to increased investments, job creation, and overall growth. However, lower interest rates can also lead to lower returns on savings and investments, potentially affecting those who rely on interest income. Additionally, the move is aimed at achieving a 3% inflation target, which can help maintain price stability and support economic growth in the long term.

How does the Reserve Bank's decision to slash the interest rate to 7% impact consumers and businesses?

The reduction in the interest rate to 7% by the Reserve Bank can have several effects on consumers and businesses. For consumers, it may lead to lower borrowing costs, making it cheaper to take out loans for big purchases like homes or cars. This could stimulate spending and investment in the economy. On the other hand, savers may see lower returns on their savings as interest rates on deposits may decrease. For businesses, lower interest rates can mean reduced costs of borrowing for expansion or investment projects, potentially boosting economic growth. However, it could also lead to increased competition among lenders, affecting their profit margins.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy. It may make borrowing cheaper, encouraging businesses and individuals to take out loans for investments or purchases. This can stimulate economic activity and potentially lead to increased spending and growth. On the other hand, lower interest rates can also reduce the returns on savings, affecting those who rely on interest income. Overall, the impact of the rate cut will depend on various factors such as consumer behavior, market conditions, and government policies.

How might the Reserve Bank's decision to lower the interest rate to 7% impact the economy and individuals?

The Reserve Bank's move to reduce the interest rate to 7% can have various effects on the economy and individuals. Lower interest rates can encourage borrowing and spending, stimulating economic activity. This can lead to increased investment in businesses, higher consumer spending, and potentially lower mortgage rates, making it cheaper for individuals to borrow money for homes or other purchases. On the flip side, lower interest rates can also lead to lower returns on savings accounts and other investments, impacting individuals who rely on interest income. Overall, the impact will depend on various factors such as the current state of the economy, consumer behavior, and market conditions.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. Lower interest rates can encourage borrowing and spending, stimulating economic activity. This can lead to increased investment in businesses, higher employment rates, and potentially higher consumer spending. On the downside, lower interest rates can also reduce the returns on savings and investments, impacting individuals who rely on interest income. Additionally, lower rates can sometimes lead to higher inflation if not carefully managed by the central bank.

How does the Reserve Bank cutting the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. For the economy, a lower interest rate can stimulate spending and investment as borrowing becomes cheaper, potentially leading to increased economic activity and growth. This move is aimed at achieving a target inflation rate of 3%, which can help stabilize prices and support sustainable economic growth. For consumers, a lower interest rate could mean reduced borrowing costs for items such as mortgages, car loans, and personal loans, making it more affordable to make large purchases or investments. However, it could also result in lower interest earned on savings accounts and other investments.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy. It can stimulate borrowing and spending, making it cheaper for businesses and individuals to take out loans for investments or purchases. This can potentially boost economic activity and encourage growth. Additionally, lower interest rates can make saving less attractive, leading people to spend more, which can further stimulate the economy. However, it's important to note that the impact of interest rate changes can vary depending on the overall economic conditions and other factors at play.

How does the Reserve Bank’s decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to reduce the interest rate to 7% can have several impacts on the economy. Lower interest rates can stimulate borrowing and spending, as it becomes cheaper for individuals and businesses to take out loans. This can lead to increased investment, job creation, and economic growth. On the other hand, lower interest rates can also lead to lower returns on savings and investments, potentially affecting those who rely on interest income. Additionally, the move is aimed at achieving a 3% inflation rate, which can help maintain price stability in the economy.

How does the Reserve Bank cutting interest rates to 7% impact the economy?

The Reserve Bank's decision to lower interest rates to 7% can have several effects on the economy. It can stimulate borrowing and spending as lower interest rates make loans cheaper, encouraging businesses and individuals to invest and consume more. This can lead to increased economic activity, potentially boosting employment and overall economic growth. On the other hand, lower interest rates can also reduce the returns on savings and investments, affecting savers and retirees who rely on interest income. Additionally, lower interest rates can sometimes lead to higher inflation as more money circulates in the economy.

How does the Reserve Bank cutting rates to 7% impact consumers and the economy?

The Reserve Bank's decision to lower interest rates to 7% can have several effects on consumers and the economy. For consumers, it could mean lower borrowing costs, making it cheaper to take out loans for things like mortgages or car purchases. This could stimulate spending and investment, potentially boosting economic activity. However, it could also lead to lower returns on savings accounts and other investments. In terms of the economy, the rate cut is aimed at achieving a 3% inflation target, which could help promote price stability and support overall economic growth.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. It can stimulate borrowing and spending, making it cheaper for businesses and individuals to take out loans for investments or purchases. This can potentially boost economic activity and growth. On the other hand, it may lead to lower interest rates on savings accounts, impacting the returns for savers. Additionally, the move aims to target a 3% inflation rate, which can influence the cost of goods and services for consumers.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and individuals?

The Reserve Bank's decision to reduce the interest rate to 7% can have several impacts on the economy and individuals. Lowering the interest rate can stimulate borrowing and spending, which can boost economic activity. This can lead to increased investment, job creation, and overall economic growth. For individuals, lower interest rates can mean reduced borrowing costs for things like mortgages and other loans, making it more affordable to make large purchases. However, lower interest rates can also result in lower returns on savings accounts and other investments, so it's important for individuals to consider the overall impact on their financial situation.

How does the Reserve Bank's decision to slash the interest rate to 7% impact consumers and businesses?

The Reserve Bank's decision to lower the interest rate to 7% can have several impacts on consumers and businesses. For consumers, it could mean lower borrowing costs on loans such as mortgages and personal loans, potentially making it more affordable to make large purchases or investments. However, it could also lead to lower returns on savings accounts and other investments. For businesses, the lower interest rate could mean reduced costs on borrowing for expansion or investment in new projects, which could stimulate economic growth. On the flip side, businesses reliant on interest income may see a decrease in their earnings.

What factors influenced the Reserve Bank's decision to slash the rate to 7%?

The Reserve Bank's decision to lower the interest rate to 7% was influenced by several factors, including the goal of achieving a 3% inflation rate. Other factors that may have played a role in this decision could include economic indicators such as GDP growth, unemployment rates, and global economic conditions.

How might the Reserve Bank's decision to lower the interest rate to 7% impact the economy and consumers?

The Reserve Bank's move to reduce the interest rate to 7% can have several effects on the economy and consumers. Lower interest rates can stimulate borrowing and spending, potentially boosting economic activity. This can lead to increased investment in businesses, higher consumer spending, and possibly a rise in asset prices such as real estate. On the other hand, lower interest rates can also lead to lower returns on savings and investments, impacting individuals who rely on interest income. Additionally, there may be concerns about potential inflationary pressures resulting from increased spending. Overall, the impact of the rate cut will depend on various factors such as individual financial circumstances, market conditions, and government policies.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to reduce the interest rate to 7% can have several implications. Lower interest rates typically make borrowing cheaper, which can encourage businesses and individuals to take out loans for investments, leading to increased spending and economic growth. On the consumer side, lower interest rates can mean reduced mortgage payments for homeowners with variable rate loans, potentially freeing up more money for other expenditures. However, it's essential to monitor how this rate cut may affect inflation, as the Reserve Bank aims for a 3% inflation rate, which can impact the purchasing power of consumers.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy. It can make borrowing cheaper, encouraging businesses and individuals to invest and spend more. This can stimulate economic growth and potentially boost employment. On the other hand, it may lead to lower interest rates on savings, affecting those who rely on interest income. Additionally, a lower interest rate can influence consumer spending and inflation rates in the economy.

How does a decrease in the Reserve Bank's interest rate to 7% impact the economy and consumers?

A decrease in the Reserve Bank's interest rate to 7% can have various effects on the economy and consumers. Lower interest rates can stimulate borrowing and spending, which can lead to increased investment, economic growth, and higher employment levels. For consumers, this may translate to lower interest rates on loans, such as mortgages and car loans, making it more affordable to borrow money. However, it can also lead to lower returns on savings accounts and other investments. Overall, the impact of a rate cut depends on various factors, including the current state of the economy and individual financial circumstances.

How does the Reserve Bank cutting the interest rate to 7% impact the economy?

The Reserve Bank's decision to slash the interest rate to 7% can have several effects on the economy. Lower interest rates typically encourage borrowing and spending, which can stimulate economic growth. Businesses may be more inclined to invest in expansion, and consumers may be more likely to take out loans for big purchases like homes or cars. However, it can also lead to lower returns on savings accounts and fixed investments, affecting those who rely on interest income. Overall, the impact on the economy will depend on various factors and how businesses and consumers respond to the rate cut.

How does the Reserve Bank lowering the interest rate to 7% impact the economy?

The Reserve Bank's decision to slash the interest rate to 7% can have several impacts on the economy. Lowering the interest rate can stimulate economic growth by making borrowing cheaper for businesses and individuals. This can lead to increased investments, higher consumer spending, and ultimately boost economic activity. However, it can also lead to lower returns on savings and investments, potentially affecting those relying on interest income. Additionally, the Reserve Bank's aim to achieve 3% inflation through this rate cut can help maintain price stability and support economic growth in the long term.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. Lowering the interest rate can stimulate borrowing and spending, as it becomes cheaper for individuals and businesses to access credit. This can lead to increased investment, consumption, and economic growth. On the other hand, lower interest rates can also lead to lower returns on savings and investments, potentially impacting savers and retirees. Additionally, the move is aimed at achieving a 3% inflation target, which can influence prices and overall purchasing power in the economy.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have various effects on the economy and consumers. It aims to stimulate economic activity by making borrowing cheaper, encouraging businesses and individuals to invest and spend more. This can lead to increased consumption, investment, and employment opportunities. However, it may also result in lower returns on savings accounts and fixed deposits for consumers. Overall, the impact will depend on how effectively the rate cut translates into economic growth and inflation management.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to slash the rate to 7% can have several impacts on the economy and consumers. Lowering the interest rate can stimulate borrowing and spending, as it becomes cheaper for consumers and businesses to access credit. This can lead to increased investments, job creation, and economic growth. On the flip side, lower interest rates can also lead to lower returns on savings and investments, affecting those who rely on interest income. Additionally, the aim for 3% inflation indicates the central bank's goal to maintain price stability, which can impact purchasing power and the cost of living for consumers.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower interest rates to 7% can have several effects on the economy. It can stimulate borrowing and spending as loans become cheaper, encouraging investment and consumption. This can lead to increased economic activity, job creation, and potentially higher inflation. On the other hand, lower interest rates can also reduce the return on savings and investments, impacting savers and investors who rely on interest income. Overall, the aim of lowering rates is to support economic growth and maintain stable inflation levels.

How does a decrease in the Reserve Bank's interest rate to 7% impact the economy?

When the Reserve Bank lowers the interest rate, it becomes cheaper for individuals and businesses to borrow money. This can lead to increased spending, investment, and borrowing, which can stimulate economic growth. Additionally, lower interest rates can make saving less attractive, encouraging people to spend or invest their money instead.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% is aimed at stimulating economic growth by making borrowing cheaper. This move can encourage businesses to invest and expand, leading to increased economic activity. For consumers, lower interest rates can mean reduced borrowing costs for things like mortgages and loans, potentially freeing up more disposable income. However, it can also impact savings accounts and term deposits, as the returns on these investments may decrease with lower interest rates.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several impacts on the economy. It can stimulate borrowing and spending as loans become cheaper, encouraging businesses and individuals to invest and consume more. This can potentially lead to increased economic activity and growth. Additionally, lowering interest rates can also help to control inflation by making it more affordable for businesses to borrow money for expansion, thereby increasing supply and stabilizing prices.

How might the Reserve Bank's decision to slash rates to 7% impact the economy and consumers?

The Reserve Bank's move to reduce interest rates to 7% can have several effects on the economy and consumers. Lower interest rates typically lead to reduced borrowing costs, which could encourage businesses and individuals to take out loans for investments or purchases. This could stimulate economic activity and potentially lead to increased spending and growth. On the other hand, lower interest rates can also result in lower returns on savings and investments, affecting savers who rely on interest income. Additionally, the central bank's goal of achieving 3% inflation through this rate cut may impact the cost of goods and services, influencing consumers' purchasing power and overall price levels in the economy.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several implications for the economy and consumers. Lowering the interest rate can stimulate economic growth by encouraging borrowing and spending, as it becomes cheaper to take out loans for investments or purchases. This can lead to increased business activity, job creation, and overall economic expansion. On the consumer side, lower interest rates can make it more affordable to borrow money for things like mortgages, car loans, and credit cards. However, it can also lead to lower returns on savings accounts and other fixed-income investments. Overall, the Reserve Bank's move aims to achieve a target inflation rate of 3%, which can help stabilize prices and support sustainable economic growth.

How does the Reserve Bank's decision to slash the interest rate to 7% impact borrowers and savers?

The Reserve Bank's decision to lower the interest rate to 7% can have different effects on borrowers and savers. Borrowers may benefit from lower interest rates on loans, making borrowing more affordable. On the other hand, savers might see lower returns on savings accounts and other investments that are tied to interest rates. It's essential for individuals to assess how this rate cut could affect their financial situation and adjust their strategy accordingly.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% is aimed at stimulating economic activity by making borrowing cheaper. This move can encourage businesses and individuals to borrow money to invest and spend, which can potentially boost economic growth. Additionally, lowering interest rates can make saving less attractive, prompting consumers to spend more, further stimulating economic activity.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have various impacts on the economy and consumers. Lowering the interest rate can stimulate economic growth by making borrowing cheaper, encouraging businesses to invest and consumers to spend more. This can lead to increased economic activity, job creation, and potentially higher inflation. However, it can also lead to lower returns on savings and investments, impacting some consumers who rely on interest income. Overall, the intention behind this decision is to manage inflation and support economic recovery.

How does a decrease in the Reserve Bank's interest rate to 7% affect the economy?

When the Reserve Bank lowers the interest rate, it becomes cheaper for individuals and businesses to borrow money. This can stimulate spending and investment, leading to increased economic activity. Additionally, lower interest rates can make saving less attractive, encouraging people to spend or invest their money instead. The aim of this rate cut, targeting 3% inflation, is to support economic growth and maintain price stability.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have various impacts on the economy. It is aimed at stimulating economic activity by making borrowing cheaper, encouraging consumers and businesses to spend and invest more. This can potentially lead to increased growth in sectors such as housing, construction, and consumer spending. However, it may also result in lower returns for savers and investors relying on interest income. Additionally, the move is part of the Reserve Bank's efforts to achieve a target inflation rate of 3%, which can influence consumer purchasing power and overall price levels in the economy.

How might the Reserve Bank's decision to slash the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can lead to cheaper borrowing costs, encouraging businesses and individuals to invest and spend more. This can stimulate economic growth and potentially lead to higher levels of employment. On the other hand, it may also reduce interest income for savers. Additionally, the central bank's target of achieving 3% inflation suggests a desire to maintain price stability and support overall economic activity.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to cut the interest rate to 7% can have several impacts on the economy. Lowering the interest rate can encourage borrowing and spending, as it becomes cheaper for individuals and businesses to take out loans. This can stimulate economic activity and potentially boost investment and consumption. On the other hand, lower interest rates can also lead to lower returns on savings and investments, which may impact certain groups of individuals, such as retirees or those relying on interest income. Overall, the Reserve Bank's move is aimed at managing inflation and supporting economic growth in the long term.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several impacts on the economy and consumers. Firstly, a lower interest rate can stimulate spending and investment, as borrowing money becomes cheaper. This can lead to increased economic activity and potentially higher employment levels. For consumers, lower interest rates can mean reduced costs on loans, such as mortgages and car loans, making it more affordable for them to borrow money. However, it can also lead to lower returns on savings accounts and other investments. Overall, the aim of reducing the interest rate is to encourage economic growth and maintain stable inflation levels.

How does the Reserve Bank cutting the interest rate to 7% impact consumers and the economy?

The Reserve Bank's decision to slash the interest rate to 7% can have several effects on consumers and the economy. Lower interest rates can lead to reduced borrowing costs, making it cheaper for individuals and businesses to take out loans for investments such as buying homes or expanding businesses. This can stimulate spending and investment, potentially boosting economic growth. On the other hand, lower interest rates can also lead to lower returns on savings accounts and other interest-bearing investments, impacting savers who rely on these funds for income. Additionally, lower interest rates can affect the exchange rate, inflation, and asset prices, all of which can have ripple effects throughout the economy.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and individuals?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and individuals. It may lead to lower borrowing costs for businesses and individuals, encouraging investment and spending. This can stimulate economic growth and potentially create more job opportunities. On the other hand, it may also result in lower returns on savings and investments, affecting individuals who rely on interest income. Additionally, the move is aimed at achieving a target inflation rate of 3%, which can help stabilize prices and maintain economic stability in the long run.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy?

The Reserve Bank's decision to cut the interest rate to 7% can have various effects on the economy. Lower interest rates can encourage borrowing and spending, stimulating economic activity and potentially boosting employment. However, it can also lead to lower returns on savings and investments, impacting individuals and businesses who rely on interest income. Additionally, the move is aimed at achieving a 3% inflation target, which can help maintain price stability and support overall economic growth.

How does the Reserve Bank's decision to slash the rate to 7% impact borrowers and savers?

The Reserve Bank's decision to lower the interest rate to 7% can have various impacts on borrowers and savers. Borrowers may benefit from lower interest rates on loans, making borrowing more affordable. On the other hand, savers may see a decrease in the interest rates they earn on their savings accounts, potentially prompting some to explore alternative investment options for better returns. It's essential for individuals to assess their financial goals and consider how this rate cut may affect their overall financial strategy.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% is aimed at stimulating economic activity by making borrowing cheaper. This can lead to increased spending and investment, which can help boost economic growth. For consumers, lower interest rates can mean reduced costs for borrowing, such as lower mortgage rates, which could make homeownership more affordable. However, it could also result in lower returns on savings accounts and other investments. Overall, the impact on the economy and consumers will depend on various factors, including how businesses and individuals respond to the rate cut.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several implications for the economy and consumers. When interest rates are reduced, borrowing becomes cheaper, which can stimulate spending and investment. This can lead to increased economic activity, potentially boosting growth and employment. On the consumer side, lower interest rates can mean lower borrowing costs for mortgages, car loans, and other types of credit, making it more affordable for individuals to make big purchases. However, lower interest rates can also result in lower returns on savings accounts and other investments, affecting those who rely on interest income. It's important to carefully consider how these changes may impact your financial situation and make informed decisions accordingly.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. Lowering interest rates can stimulate borrowing and spending, which can boost economic activity. It can make borrowing cheaper for consumers and businesses, encouraging investment and consumption. However, it may also lead to lower returns on savings and investments, affecting those who rely on interest income. Overall, the aim of reducing the interest rate is to help achieve the target inflation rate of 3% set by the Reserve Bank.

How will the Reserve Bank's decision to lower the interest rate to 7% impact the economy?

The Reserve Bank's decision to reduce the interest rate to 7% can have several effects on the economy. Lower interest rates typically encourage borrowing and spending, which can stimulate economic growth. It can make borrowing more affordable for businesses and individuals, leading to increased investments, consumer spending, and potentially higher employment rates. However, it can also lead to lower savings rates and potentially higher inflation if demand outpaces supply. Overall, the impact will depend on various economic factors and how effectively the policy is implemented.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy. It can potentially stimulate borrowing and spending, as lower interest rates make it cheaper for individuals and businesses to take out loans. This can lead to increased investment in various sectors, which may boost economic activity and growth. On the other hand, lower interest rates can also affect savers, as they may receive lower returns on their savings accounts. Overall, the impact of the rate cut will depend on various factors, including how consumers, businesses, and financial markets respond to the change.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and everyday consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. It may lead to lower borrowing costs for businesses and individuals, stimulating spending and investment. This can potentially boost economic activity and employment. However, it could also mean lower interest earnings for savers and retirees who rely on fixed-income investments. Additionally, the move is aimed at achieving a 3% inflation target, which could impact the purchasing power of consumers and the overall cost of living.

How will the Reserve Bank's rate cut to 7% impact the economy?

The Reserve Bank's decision to slash the interest rate to 7% is aimed at stimulating economic activity by making borrowing cheaper. This move can encourage businesses to invest more, consumers to spend more, and homeowners to refinance their mortgages at lower rates. Ultimately, the goal is to boost economic growth and potentially increase inflation to the target rate of 3%.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and individuals?

The Reserve Bank's decision to decrease the interest rate to 7% can have several effects on the economy and individuals. Lower interest rates generally make borrowing cheaper, encouraging businesses and individuals to invest and spend more. This can stimulate economic growth and potentially lead to increased employment opportunities. On the other hand, lower interest rates can also impact savers, as they may receive lower returns on their savings. Overall, the rate cut is aimed at achieving a target inflation rate of 3%, which is considered healthy for the economy.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy. It may lead to lower borrowing costs for consumers and businesses, potentially stimulating increased spending and investment. This can help boost economic activity and support growth. Additionally, lower interest rates can make saving less attractive, encouraging people to spend or invest their money instead. On the other hand, a cut in interest rates can also lead to lower returns on savings and investments, affecting those who rely on interest income. Overall, the impact of the rate cut will depend on various factors such as consumer behavior, business sentiment, and global economic conditions.

How does the Reserve Bank's decision to lower the interest rate to 7% impact the economy and consumers?

The Reserve Bank's move to slash the interest rate to 7% can have several effects on the economy and consumers. A lower interest rate typically makes borrowing cheaper, encouraging businesses and individuals to invest and spend more. This can stimulate economic growth, increase consumer spending, and boost investments in areas such as real estate and businesses. However, it can also lead to lower returns on savings and investments, affecting those who rely on interest income. Overall, the impact of the rate cut will depend on various factors such as the state of the economy, inflation levels, and consumer behavior.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy. By reducing the cost of borrowing, individuals and businesses may be more inclined to take out loans for investments, leading to increased spending and economic growth. Additionally, lower interest rates can make saving less attractive, potentially encouraging consumers to spend more, further stimulating economic activity. However, it's important to note that the impact of interest rate changes can vary depending on various factors such as the overall economic conditions and consumer sentiment.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. Lowering the interest rate can stimulate borrowing and spending, as it becomes cheaper for individuals and businesses to take out loans. This can lead to increased investments, which can boost economic activity and potentially lead to job creation. However, lower interest rates can also lead to lower returns on savings accounts and other investments, affecting individuals who rely on interest income. Additionally, a lower interest rate can also impact inflation rates, as it is often used as a tool by central banks to control inflation levels.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to cut the interest rates can have several effects on the economy and consumers. It can lead to lower borrowing costs for businesses and individuals, which may stimulate investment and spending. This can potentially boost economic activity and job creation. On the other hand, lower interest rates can also impact savers who may receive lower returns on their savings. Additionally, the move aims to achieve a target inflation rate of 3%, which can help in maintaining price stability and promoting overall economic growth.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have various impacts on the economy and consumers. It can stimulate borrowing and spending by making loans cheaper, which may encourage businesses to invest and consumers to make big purchases. On the other hand, it can also lead to lower returns on savings and fixed-income investments, affecting those who rely on interest income. Additionally, the aim for a 3% inflation rate indicates the central bank's effort to maintain price stability and support economic growth.

How does the Reserve Bank cutting interest rates to 7% impact the economy?

When the Reserve Bank lowers interest rates, it becomes cheaper for businesses and individuals to borrow money. This can stimulate spending and investment, which can help boost economic growth. Additionally, lower interest rates can lead to increased consumer spending and higher demand for goods and services, ultimately aiming to achieve the target inflation rate of 3%.

How does the Reserve Bank cutting the interest rate to 7% impact the economy and consumers?

When the Reserve Bank reduces the interest rate, it becomes cheaper for banks to borrow money, encouraging them to lend more to businesses and individuals. This can stimulate spending, investment, and borrowing, ultimately boosting economic activity. For consumers, lower interest rates can mean reduced borrowing costs for mortgages, loans, and credit cards, potentially leading to increased spending and investment in the economy.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to lower the interest rate to 7% can have several impacts on the economy. It can stimulate borrowing and spending by making it cheaper for individuals and businesses to access credit, which can help boost economic activity. Lower interest rates can also make saving less attractive, potentially encouraging people to invest in assets like stocks or real estate. Additionally, a lower interest rate can lead to a depreciation of the currency, which can help improve export competitiveness and support economic growth. However, it's important to note that the effectiveness of interest rate changes in achieving specific economic goals, such as targeting a 3% inflation rate, can vary depending on other factors at play in the economy.

How does the Reserve Bank cutting interest rates to 7% affect consumers and the economy?

When the Reserve Bank cuts interest rates, it becomes cheaper for consumers to borrow money, which can lead to increased spending on goods and services. This can stimulate economic growth and encourage investment. On the other hand, lower interest rates can also lead to decreased savings returns for individuals and potentially higher inflation rates. Overall, the impact of a rate cut depends on various factors such as the state of the economy, consumer behavior, and government policies.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. Lowering the rate can stimulate spending and investment by making borrowing cheaper, which can help boost economic activity and growth. This could lead to increased consumer spending, business investment, and potentially higher asset prices. On the other hand, lower interest rates can also lead to lower returns on savings accounts and other fixed-income investments, which may impact consumers relying on these sources of income.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several impacts on the economy and consumers. It can make borrowing cheaper, encouraging businesses and individuals to take out loans for investments or purchases. This can stimulate economic activity and potentially lead to higher spending and growth. However, lower interest rates can also mean lower returns on savings accounts and other investments, affecting savers who rely on interest income. Additionally, the move is part of the Reserve Bank's efforts to target a 3% inflation rate, which can influence prices and the overall cost of living for consumers.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy?

The Reserve Bank's decision to reduce the interest rate to 7% can have various effects on the economy. Lowering the interest rate typically stimulates borrowing and spending, which can boost economic activity. It can encourage businesses to invest in expansion and create more jobs. Conversely, it may also lead to inflation if demand for goods and services outpaces supply. This decision is aimed at achieving a 3% inflation target, which is a key indicator of a healthy economy.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several impacts on the economy and consumers. By reducing the cost of borrowing, individuals and businesses may be more inclined to take out loans for investments or purchases, which can stimulate economic activity. Lower interest rates can also lead to increased spending and investment, ultimately boosting economic growth. However, it can also potentially lead to higher inflation if demand outstrips supply. For consumers, this decision could mean lower interest rates on loans, such as mortgages and car loans, making it more affordable to borrow money. On the other hand, it may result in lower returns on savings accounts and other interest-bearing investments.

How does the Reserve Bank's decision to cut rates to 7% impact the economy?

The Reserve Bank's decision to lower interest rates to 7% can have several effects on the economy. Firstly, it can stimulate borrowing and spending as lower interest rates make it cheaper for businesses and individuals to take out loans. This increased spending can lead to economic growth and investment. Additionally, lower interest rates can also make saving less attractive, encouraging people to invest in other assets such as stocks or real estate. However, there can also be downsides such as potential inflationary pressures or asset bubbles. Overall, the impact of the rate cut will depend on various factors including the current state of the economy and how businesses and consumers respond to the change in interest rates.

How does the Reserve Bank cutting the interest rate to 7% impact the economy and consumers?

When the Reserve Bank lowers the interest rate to 7%, it becomes cheaper for individuals and businesses to borrow money. This can stimulate spending and investment, potentially boosting economic activity. Additionally, lower interest rates can lead to reduced mortgage repayments for homeowners with variable rate loans, providing some relief to consumers. On the flip side, savers may earn less interest on their savings, and there could be concerns about the impact on inflation and asset prices.

How does the Reserve Bank's decision to slash the interest rate to 7% impact the economy and consumers?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and consumers. Lowering the interest rate can stimulate economic growth by encouraging borrowing and spending. This can lead to increased investment, job creation, and overall economic activity. However, for consumers, it may mean lower interest rates on loans, such as mortgages and car loans, making borrowing more affordable. On the flip side, it could also lead to lower interest rates on savings accounts, potentially reducing the returns for savers.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and individuals?

The Reserve Bank's decision to lower the interest rate to 7% can have several effects on the economy and individuals. For the economy, it may stimulate borrowing and spending, leading to increased economic activity and potentially higher inflation. For individuals, it could mean lower interest rates on loans, such as mortgages and car loans, making borrowing more affordable. However, it could also result in lower returns on savings accounts and other investments.

How does the Reserve Bank's decision to slash the rate to 7% impact the economy and inflation rate?