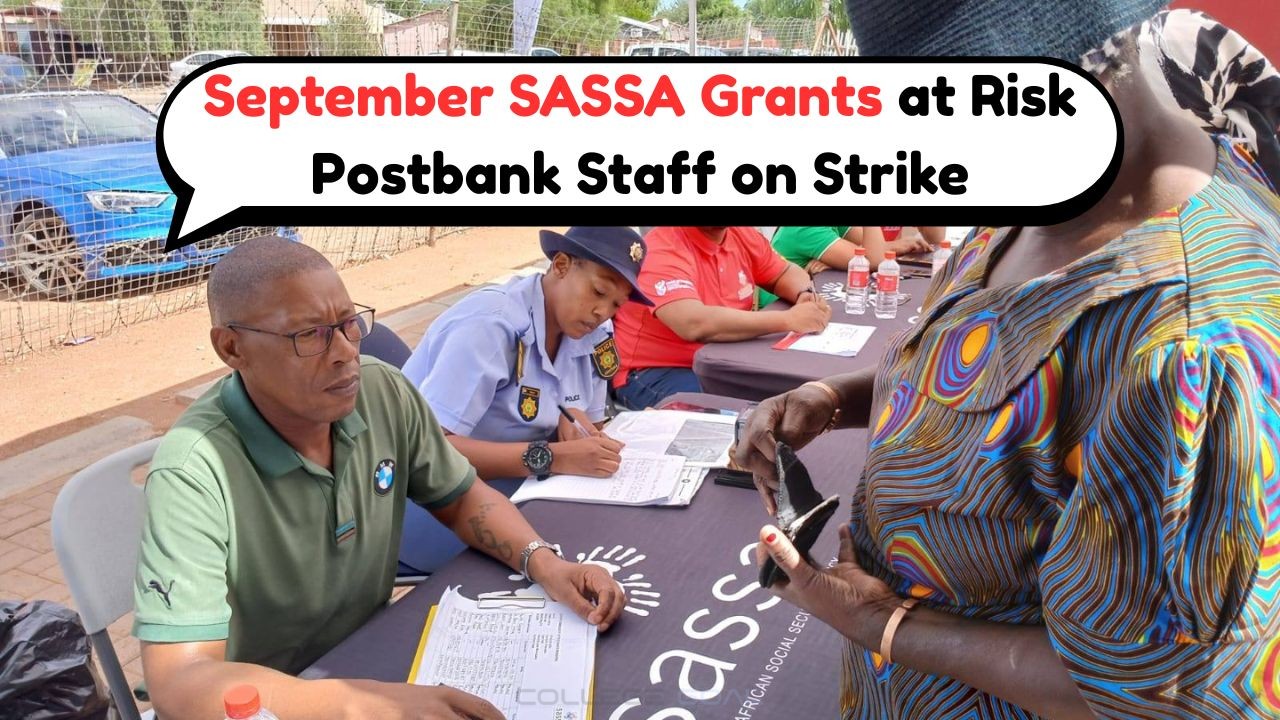

September SASSA Payments in Jeopardy: In a startling development, the September SASSA (South African Social Security Agency) payments may face significant disruptions due to a looming strike by Postbank employees. Postbank, which plays a crucial role in the disbursement of these funds, is at an impasse with its workers over wage negotiations. This strike, if it proceeds, could affect millions of South Africans who rely on these payments for their daily needs. Thankfully, the government isn’t standing idle. An emergency plan is being crafted to ensure that the most vulnerable citizens continue to receive their financial support without delay. This situation has sparked widespread concern across the country, prompting many to question the resilience and reliability of the current welfare payment infrastructure.

Impact of Postbank Strike on September SASSA Payments

The potential strike by Postbank employees is poised to significantly impact SASSA beneficiaries across South Africa. Postbank is responsible for processing and distributing social grants, including old age pensions, child support grants, and disability benefits. A disruption could lead to delays and uncertainty for millions relying on these payments. The timing of the strike, coinciding with the monthly disbursement cycle, exacerbates the potential fallout. Beneficiaries, particularly in rural areas, might face significant hardships if payments are delayed. The strike threatens to unravel the delicate balance of financial stability for those living below the poverty line, highlighting the critical need for contingency measures.

Are You Eligible for the R1,250 Foster Grant Payments Starting This August? Find Out Now with SASSA

Are You Eligible for the R1,250 Foster Grant Payments Starting This August? Find Out Now with SASSA

- Old age pensions

- Child support grants

- Disability benefits

- Foster care grants

- Care dependency grants

- Grant-in-aid

- Social relief of distress

Government’s Emergency Plan for SASSA Payments

Recognizing the potential crisis, the South African government has swiftly moved to devise an emergency plan. This plan includes deploying additional resources to ensure that SASSA payments are not interrupted. Alternative payment channels are being explored, including partnerships with private financial institutions, to provide beneficiaries with access to their funds. The government aims to minimize disruption by leveraging technology and existing banking infrastructure to facilitate direct deposits into beneficiaries’ accounts. Communication is also a key element, with efforts to keep all parties informed and updated on the situation. This proactive approach underscores the government’s commitment to safeguarding the welfare of its citizens.

- Alternative payment channels

- Partnerships with banks

- Direct deposit facilitation

- Resource allocation

- Communication strategies

- Technological solutions

- Beneficiary support

Potential Outcomes of the Postbank Strike

As the deadline for wage negotiations approaches, the potential outcomes of the Postbank strike remain uncertain. If an agreement is reached, normalcy in SASSA payments can resume without issue. However, if the strike proceeds, the ramifications could extend beyond delays. There is a risk of eroding trust in the social grant system, which could lead to increased public dissatisfaction and pressure on the government to find long-term solutions. The strike might also highlight the need for a diversified payment system that reduces reliance on a single entity. This could be a pivotal moment for reassessing and strengthening the overall social welfare infrastructure in South Africa.

| Outcome | Impact | Response | Future Implications | Stakeholders |

|---|---|---|---|---|

| Agreement Reached | Normalcy Restored | Continued Operations | Strengthened Trust | Postbank, SASSA |

| Strike Proceeds | Payment Delays | Emergency Measures | System Reevaluation | Beneficiaries, Government |

Alternative Solutions for SASSA Payment Distribution

In light of the looming strike, exploring alternative solutions for SASSA payment distribution becomes imperative. Several strategies can be considered to mitigate future risks and ensure uninterrupted service. Firstly, increasing collaboration with commercial banks can provide a broader network for disbursement. Secondly, adopting mobile banking solutions can enhance accessibility, especially in remote areas. Additionally, implementing a multi-channel payment system can distribute the load and minimize dependency on any single entity. Encouraging the use of digital wallets and prepaid cards may also offer beneficiaries more flexibility in accessing their funds. These solutions not only address immediate challenges but also pave the way for a more resilient and adaptable system.

- Collaboration with banks

- Mobile banking solutions

- Multi-channel payment system

- Digital wallets

- Prepaid cards

Challenges in Implementing SASSA Payment Alternatives

While alternative payment solutions present a promising avenue, their implementation comes with a set of challenges. Infrastructure limitations, particularly in rural areas, pose a significant hurdle. Moreover, ensuring digital literacy among beneficiaries is crucial for the success of technological solutions. The financial implications of transitioning to new systems also require careful consideration. Resistance to change from both beneficiaries and service providers could slow down progress. It is essential to address these challenges through strategic planning, investment in infrastructure, and conducting awareness campaigns to educate and encourage adoption among users.

| Challenge | Solution |

|---|---|

| Infrastructure Limitations | Investment in Connectivity |

| Digital Literacy | Awareness Campaigns |

| Financial Implications | Cost-Benefit Analysis |

| Resistance to Change | Stakeholder Engagement |

Insights from Previous SASSA Payment Disruptions

Looking back at past disruptions in SASSA payments can provide valuable insights into managing the current crisis. Previous incidents have highlighted the importance of having robust contingency plans and the need for clear communication with beneficiaries. Learning from these experiences, the government and stakeholders can better anticipate and address potential issues. Building a more diverse and sustainable payment network can prevent future disruptions and enhance the resilience of the social grant system. By leveraging past lessons, South Africa can ensure that its most vulnerable citizens continue to receive the support they depend on.

FAQ Section

| Question | Answer |

|---|---|

| What is causing the potential disruption in SASSA payments? | A looming strike by Postbank employees over wage negotiations is threatening to disrupt SASSA payments. |

| How does the government plan to handle the payment disruption? | The government is implementing an emergency plan that includes alternative payment channels and partnerships with banks. |

| What are some of the alternative solutions for SASSA payments? | Alternative solutions include collaborations with banks, mobile banking, and digital wallets. |

| What challenges are associated with implementing alternative payment methods? | Challenges include infrastructure limitations, digital literacy, financial costs, and resistance to change. |

| What can be learned from previous SASSA payment disruptions? | Previous disruptions emphasize the need for contingency plans, clear communication, and a diverse payment network. |

Looking Ahead: Strengthening SASSA Payment Systems

Future-proofing the SASSA payment system is essential to prevent similar disruptions. By investing in technology, increasing stakeholder collaboration, and enhancing communication strategies, South Africa can build a more resilient and reliable social grant system. This approach will ensure that beneficiaries receive their payments on time, regardless of unforeseen challenges.

Continued vigilance and proactive measures will be key in maintaining the stability of social welfare systems. Stakeholders must work together to address current challenges and build a sustainable future.

Through strategic investments and innovative solutions, the South African government can reinforce the safety net for its most vulnerable citizens. By learning from past experiences and embracing change, a stronger, more adaptable system can be developed.

As the situation unfolds, staying informed and prepared will be crucial for beneficiaries and policymakers alike. Together, they can navigate these challenges and ensure that social grants continue to support those in need.

In the face of uncertainty, resilience and collaboration will shine through, safeguarding the future of social grants in South Africa.